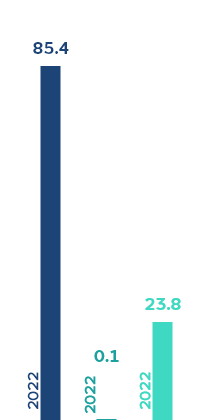

We are committed to the goal of the Paris Climate Agreement, which aims to limit global warming to 1.5 degrees Celsius compared to the pre-industrial level. We are working hard to achieve this and want to be carbon neutral by no later than 2040.

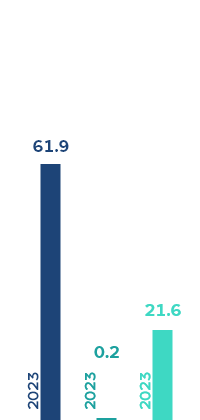

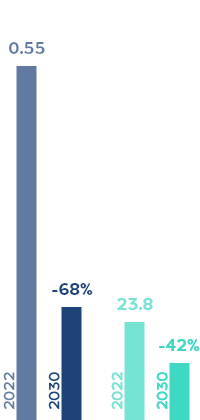

This applies to our own greenhouse gas emissions, as well as our upstream and downstream value chain. In 2023, we raised our targets for 2030. Our base year for these assessments is 2022. Our targets aim to bring greenhouse gas emissions in line with the 1.5 degree climate benchmark. When the report was published, the independent Science Based Targets initiative was yet to confirm this assessment.

Scope 3

Emissions from our upstream and downstream value chains

Scope 2

Emissions from our purchased and consumed energy

Scope 1

Emissions from our operating activities

CO2 equivalents (CO2e) in million metric tons; CO2e is a unit of measurement used to standardise the climate effects of various greenhouse gases.

Scope 3

Emissions from our upstream and downstream value chains

Scope 2

Emissions from our purchased and consumed energy

Scope 1

Emissions from our operating activities

CO2 equivalents (CO2e) in million metric tons; CO2e is a unit of measurement used to standardise the climate effects of various greenhouse gases.

Scope 3

Overall reduction target for emissions from our upstream and downstream value chains

Scope 1 & 2

Relative reduction target per kWh of power generated for emissions from our operating activities and emissions from our purchased and consumed energy

The baseline year for our emission reduction targets is fiscal 2022. Baseline year and target values are subject to validation by the Science Based Targets initiative.