RWE successfully issues its first inaugural US dollar green bond, marking a significant step into US debt financing

12.04.2024

RWE’s operational performance in the fourth quarter of fiscal 2021 exceeded expectations. In particular, the Hydro/Biomass/Gas segment as well as Supply & Trading performed far better towards year end than assumed. Overall, it resulted in an outperformance of the outlook for fiscal 2021, based on preliminary figures.

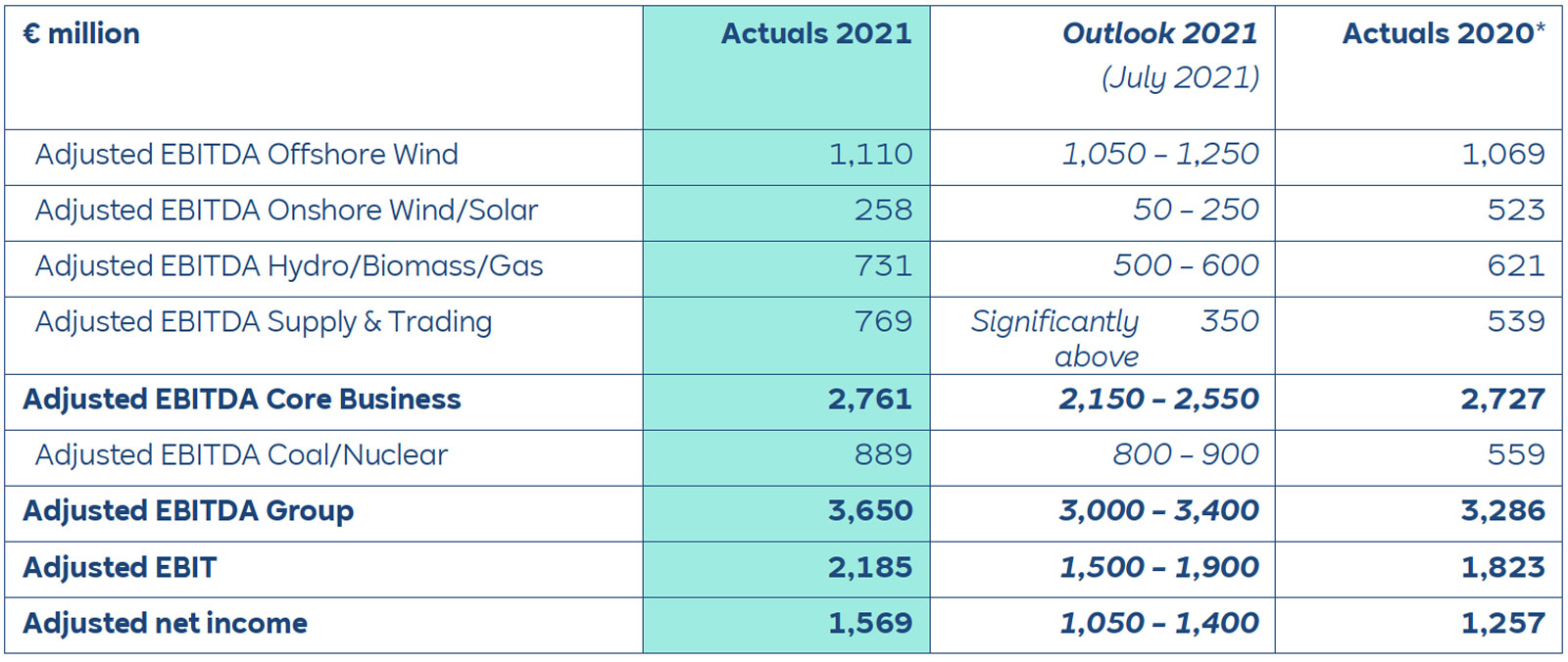

RWE Group’s adjusted EBITDA (earnings before interest, taxes, depreciation and amortisation) is expected to reach €3.65 billion and therefore to pass the upper end of the forecasted range of €3.0 billion to €3.4 billion. Adjusted EBITDA in the core business is assumed to be €2.76 billion and therefore above the upper end of the guided range of €2.15 billion to €2.55 billion. Adjusted EBIT for 2021 is expected to be €2.19 billion, against earnings forecast between €1.5 billion and €1.9 billion. Adjusted net income is expected to reach €1.57 billion, above the guidance of €1.05 billion to €1.4 billion. Net debt as of 31 December 2021 is expected to be significantly below the level at the end of September 2021, which was at €2.9 billion.

In view of the expected strong results, Michael Müller commented on the planned dividend:

“We confirm our dividend target of €0.90 per share for fiscal 2021 and we will propose this to our Annual General Meeting on 28 April 2022, which will be held virtually.”

Performance in the core business per segment (preliminary earnings)

Offshore Wind: Adjusted EBITDA to be at €1,110 million and with this slightly above previous year. Mainly portfolio effects in the UK from the full consolidation of the offshore wind farm Rampion and the commissioning phase of the Triton Knoll wind farm overcompensated year-on-year weaker wind conditions.

Onshore Wind/Solar: Adjusted EBITDA expected to just top the upper end of guidance and to be at €258 million. Year-on-year earnings are lower, primarily impacted by the negative effect from the unprecedented Texas cold snap in February 2021, which reduced earnings by approximately €400 million.

Hydro/Biomass/Gas: Adjusted EBITDA to increase to €731 million, thanks to a very good performance at the end of 2021, mainly on the back of a strong day-to-day optimisation of the power plant dispatch.

Supply & Trading: To record an adjusted EBITDA at €769 million, due to an excellent performance in the trading business in particular in the first half of 2021.

On top of RWE’s core business, adjusted EBITDA from Coal/Nuclear expected to be at €889 million. The year-on-year increase in earnings is due to realised higher generation margins. Earnings are within the guided range.

All figures are preliminary. Final figures for fiscal 2021 will be released as planned on 15 March 2022.