Hydrogen

How RWE is actively helping to shape the age of hydrogen.

Hydrogen is a key technology for decarbonisation, especially in industry and the transport sector. Many pilot projects involving hydrogen applications have been launched, including in heavy-duty transport, in the chemical and steel industries, and for replacing grey hydrogen in refineries. Initial investment decisions such as the supply contract between RWE and TotalEnergies for 30,000 tonnes p.a. of green hydrogen from Lingen to Leuna demonstrates that the hydrogen ramp-up can work.

Progress is also being made in expanding the necessary infrastructure, which lays the foundation for connecting supply and demand – the first sections of the national hydrogen core network have already been converted from natural gas to hydrogen. What is important now is its consistent, timely and demand-driven expansion.

Nevertheless, as with any new technology, the cost gap between renewable and low-carbon hydrogen and the currently used grey hydrogen remains large. Instead of bridging this gap, current regulations are actually set to widen it significantly by 2030. Many transitional regulations designed to support the initial market ramp-up are set to expire. In Germany, for example, these include the exemption of electrolysers from electricity grid fees and levies, as well as EU-wide facilitations for the procurement of electricity to produce green hydrogen.

It is therefore high time to act and ensure that hydrogen can deliver on its promise of being a true decarbonisation option at reasonable cost. The potential for cost reduction is enormous. If the right decisions are made, both domestic production of electrolytic hydrogen and imports will become competitive with grey hydrogen and available in large volumes. This will also ensure efficient utilisation of infrastructure and enable a reliable planning to be carried out for the decarbonisation of the transport sector and industry.

With the legal framework currently set for 2030, the full cost of green hydrogen for future projects is around €11/kg H2 for the customer – even after accounting for technical advances and revenues from system services. These costs include investment and operating expenses, the price of electricity used, plus grid fees and levies applicable to new electrolyser installations from 2030. They also cover costs for transport and demand-based hydrogen delivery. This is far too high, as the competing product, grey hydrogen (excluding CO2 costs), costs only about €3/kg H2.

The good news is that hydrogen’s competitiveness can be significantly increased by reducing production and supply costs. The biggest lever for substantially lowering the full cost is pragmatic regulatory simplification:

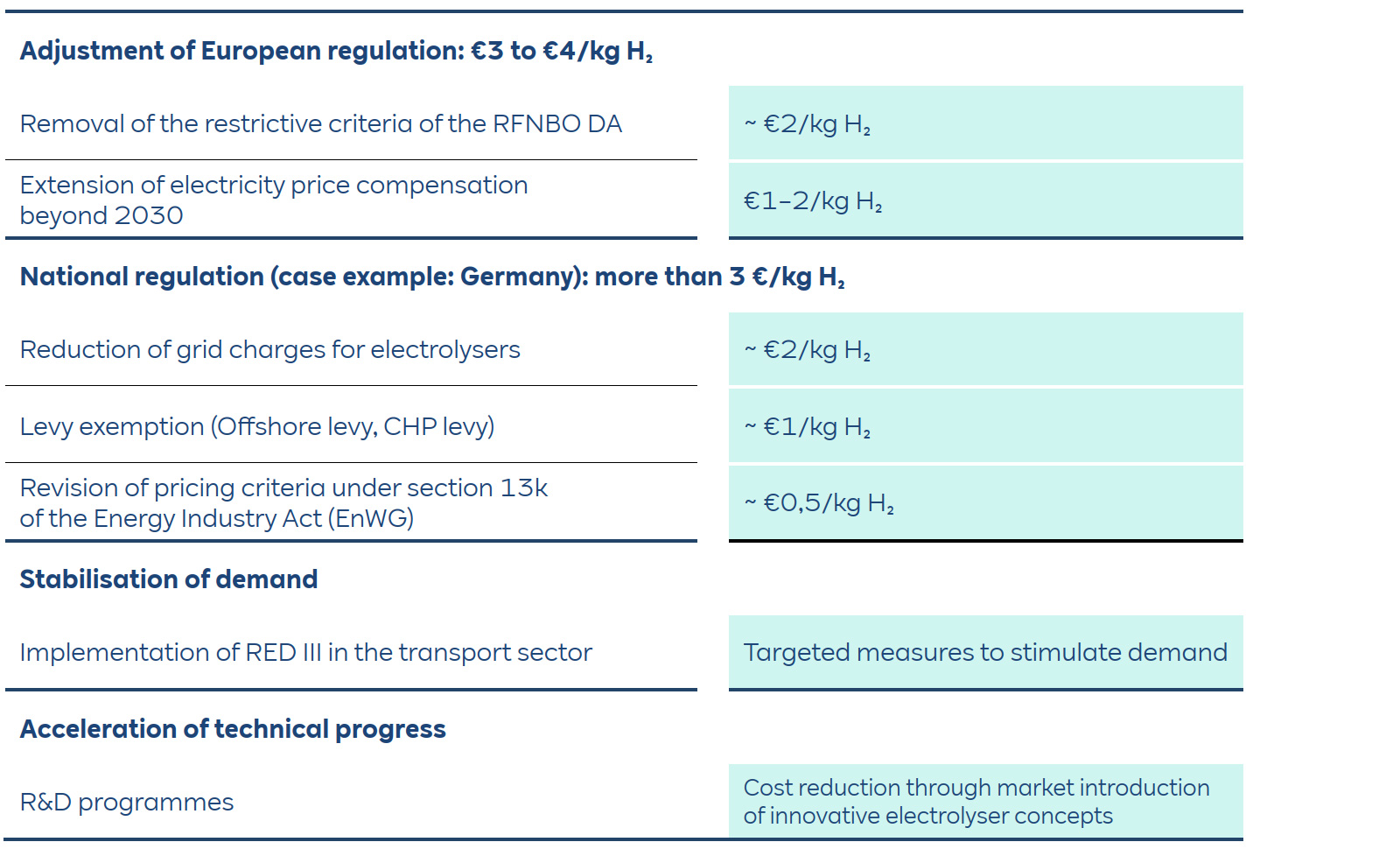

a. Adjustment of European regulation: €3 to €4/kg H2

The European Emissions Trading Scheme is fully sufficient as an incentive instrument; the Delegated Act adds no value. By abolishing the restrictive criteria of the Delegated Act for green hydrogen (“RFNBO”), costs in Germany can be reduced by about €2/kg H2. Moreover, improved electricity availability would both reduce operational risks for electrolysers and enable continuous supply to customers. Fluctuating hydrogen production due to variable renewable power supply would be eliminated and the need for physical interim storage significantly reduced.

A permanent extension of electricity price compensation, which expires after 2030, would strengthen the competitiveness of European industry. At the same time, costs for green hydrogen could be reduced by a further €1 to 2/kg H2 from 2030 onwards.

b. Supportive national regulation: more than €3/kg H22

With the right regulatory framework adjustments, the cost reduction potential for domestic green hydrogen production is over €3/kg H2 overall:

Overall effect: With these changes to EU and national regulations, the total cost of green hydrogen in Germany in 2030 could drop from roughly €11 to below €6/kg H2.

In addition to the competitiveness of hydrogen, stabilising customer demand is crucial. Demand, particularly in the transport sector including refineries, can be boosted significantly with the forthcoming national implementation of RED III in the transport sector.

National greenhouse gas reduction targets up to 2040 and the introduction of a sub-quota for RFNBOs, which exceeds the original EU requirements of RED, have the potential to provide substantial support for the ramp-up of hydrogen. These incentives can encourage more investment decisions to be made.

Innovative electrolyser concepts offer considerably higher efficiency and lower investment costs, but are not yet market-ready. A research and development programme, supported by the government and directed towards European plant manufacturers, would firstly mitigate the risk associated with technology development, thereby supporting market introduction and subsequent cost reductions for hydrogen; and secondly, it would strengthen independence from technology imports.

The ramp-up of hydrogen will succeed – if we do it right and adjust the regulatory framework as soon as possible. The proposals outlined above show a way forward.