- Adjusted EBITDA for the first three months of 2025 reaches €1.3 billion, adjusted net income amounts to €0.5 billion

- Strong capacity growth of 2.5 gigawatts since March 2024, including 600 megawatts in the first three months of 2025 alone; further assets with a combined capacity of 11.2 gigawatts under construction

- Outlook for 2025 and dividend target of €1.20 per share confirmed

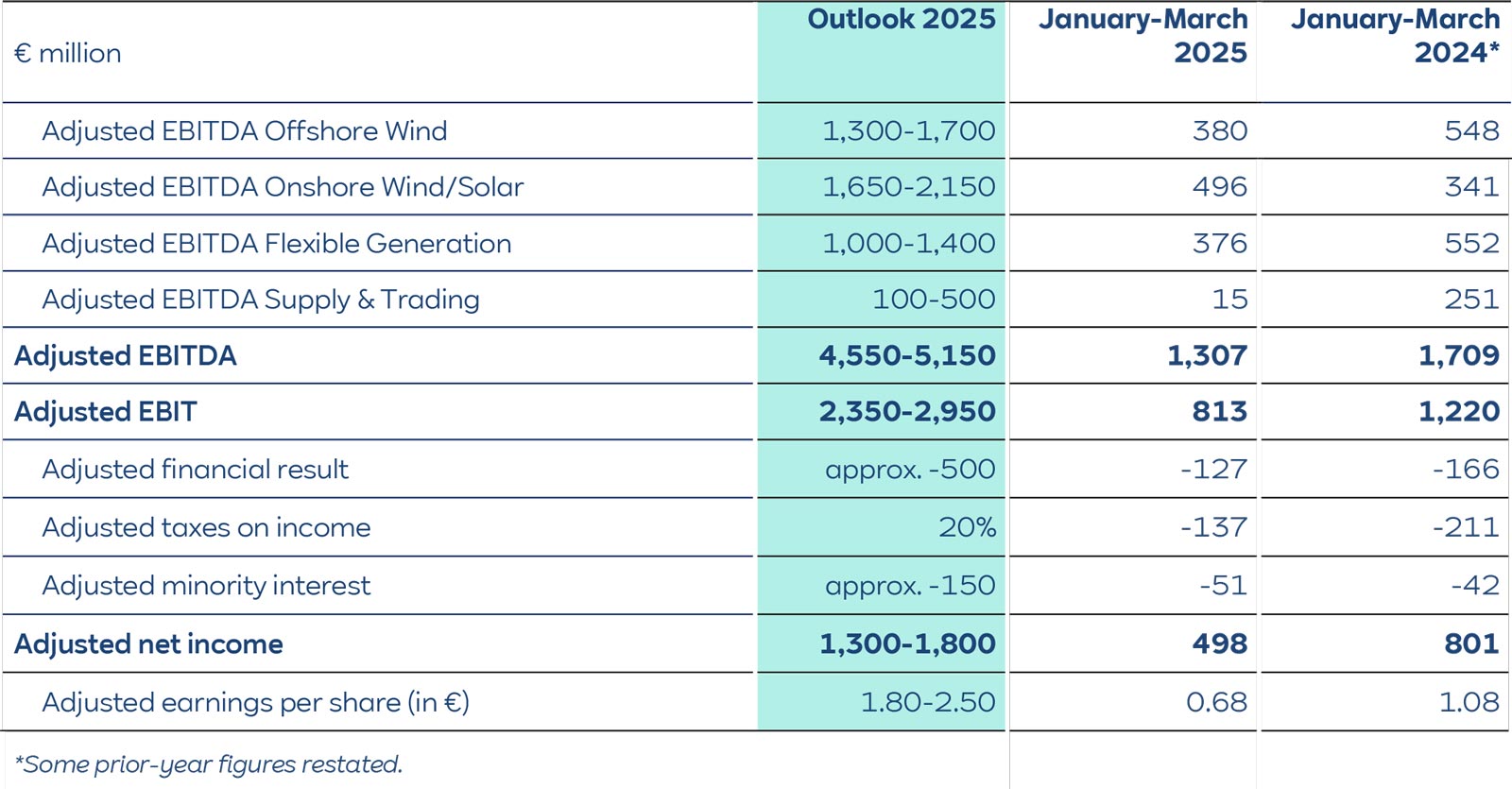

In the first quarter of 2025, RWE posted adjusted EBITDA (adjusted earnings before interest, taxes, depreciation and amortisation) of €1.3 billion and adjusted net income of €0.5 billion. As expected, earnings were below the level of the same quarter last year. This is primarily attributable to a normalisation of income in the Flexible Generation segment and a weaker start to the year in the trading business. The commissioning of new onshore wind farms, solar plants and battery storage facilities had a positive impact. However, weak wind conditions in Europe led to lower offshore and onshore wind power production, resulting in a decline in earnings. RWE forged ahead with the expansion of its generation portfolio in the first quarter of 2025, investing €2.7 billion net. The company currently has new plants with a combined capacity of 11.2 gigawatts under construction.

Michael Müller, CFO of RWE AG: “After a solid start to the year, we are reaffirming our full-year earnings forecast for 2025. We are making great progress in expanding our portfolio in a value-accretive manner. In the first three months of this year alone, we commissioned 600 megawatts of new generation capacity. And our construction projects are on schedule and on budget. This year and next, we will complete plants with a total capacity of 8 gigawatts, including our large-scale Sofia offshore wind farm in the United Kingdom.”

Business development in the first quarter of 2025 by segment

Offshore Wind: Adjusted EBITDA in the Offshore Wind segment reached €380 million, compared with €548 million in the first quarter of 2024. The main reason for the decrease was lower earnings due to poor wind conditions. In addition, prices and margins for electricity forward sales declined.

Onshore Wind/Solar: The Onshore Wind/Solar segment achieved adjusted EBITDA of €496 million compared with €341 million in the first quarter of 2024. The commissioning of new plants led to earnings growth despite generally poor wind conditions at the European sites. In addition, hedged prices on electricity sales in the US were significantly higher than last year. In Europe, by contrast, lower hedged prices were realised overall.

Flexible Generation: The level of adjusted EBITDA for the Flexible Generation segment normalised in the first quarter of 2025 and, as expected, decreased to €376 million compared to €552 million in last year’s corresponding period. Margins on electricity forward sales did not reach the high level of the first quarter of 2024. Additional income from the short-term optimisation of power plant dispatch could only make up a small portion of the shortfall.

Supply & Trading: Adjusted EBITDA for the segment was €15 million, significantly below the above-average prior-year figure of €251 million, mainly due to a weak performance in proprietary trading. For the full year 2025, RWE continues to expect earnings in the range of €100 million to €500 million.

As of fiscal 2024, RWE has pooled the lignite-fired power generation business and the nuclear decommissioning activities in the Phaseout Technologies segment and has been managing them based on adjusted cash flows. This business is no longer included in adjusted EBITDA, adjusted EBIT or adjusted net income.

Robust financial position despite high investments: As of 31 March 2025, RWE reported net debt of €15.9 billion. Debt rose compared to the end of 2024, mainly due to high capital expenditure and seasonal effects on operating cash flows. RWE will further invest in growth projects in the current financial year. However, with planned total investments of €7 billion net in fiscal 2025, these are significantly below the 2024 level. RWE continues to expect that it will be able to maintain its self-imposed upper limit of 3.0 for the leverage factor, i.e. the ratio of net debt to adjusted EBITDA.

Outlook for 2025: RWE expects adjusted EBITDA in the current fiscal year to be in a range between €4.55 billion and €5.15 billion and adjusted net income to be between €1.3 billion and €1.8 billion. Management envisages raising the dividend for 2025 to €1.20 per share.

Details on the earnings forecast for the individual segments can be found in the Annual Report 2024.