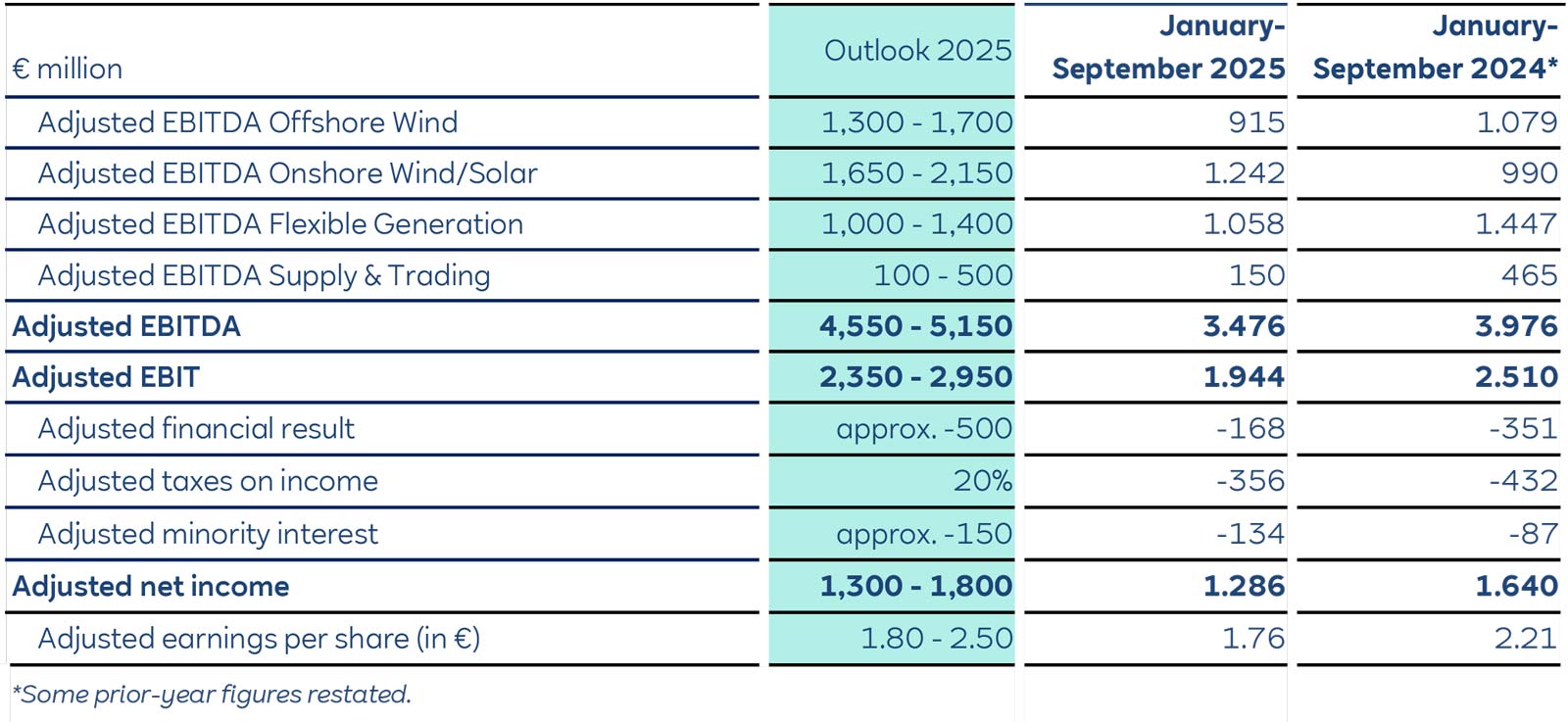

- Adjusted EBITDA for the first three quarters of 2025 reaches €3.5 billion, adjusted net income amounts to €1.3 billion

- Adjusted net earnings per share of €1.76 – more than 80% of EPS guidance for fiscal 2025 of €2.10 per share already achieved

- Positive one-off effect in the Flexible Generation segment of €225 million from the sale of a UK data centre project to a hyperscaler

- Guidance and dividend target for fiscal 2025 confirmed, adjusted EPS targets of €3 for 2027 and €4 for 2030 also confirmed

In the first nine months of 2025, RWE posted adjusted EBITDA of €3.5 billion and adjusted net income of €1.3 billion. Adjusted net earnings per share amounted to €1.76. As expected, earnings for the first three quarters were lower than in the same period last year. This is primarily due to a normalisation of income in the Flexible Generation segment and the weaker trading business compared to the previous year. In addition, lower wind speeds in Europe led to lower wind power production, resulting in a decline in earnings. The commissioning of new onshore wind farms, solar plants and battery storage systems had a positive impact.

Since the end of September 2024, RWE has commissioned a total of around 2.5 gigawatts (GW) of new generation capacity. This means that RWE currently operates an integrated portfolio of 38.7 GW of renewable energy assets, battery storage systems and flexible generation. The company has a further 11.4 GW under construction, more than 2 GW of which is expected to be commissioned by the end of 2025. This will increase the portfolio to over 40 GW.

Michael Müller, CFO of RWE AG: “We are satisfied with the results for the first nine months. We confirm our guidance for the current fiscal year and our earnings targets for 2030. Our portfolio is robust and growing in a value-accretive way. The artificial intelligence boom is driving worldwide demand for electricity and, thus, the demand for renewable energy. These are good prospects for our business.”

Business development in the first three quarters of 2025 by segment

Offshore Wind: Adjusted EBITDA in the Offshore Wind segment reached €915 million, compared with €1,079 million in the first three quarters of 2024. The main reason for the decrease was lower earnings due to the significant deterioration in wind conditions compared to 2024. In addition, proceeds on forward sales of electricity for which RWE does not receive a guaranteed price were lower than in 2024.

Onshore Wind/Solar: The Onshore Wind/Solar segment achieved adjusted EBITDA of €1,242 million compared to €990 million in the first three quarters of 2024. The commissioning of new generation assets led to earnings growth despite the weak wind conditions at European sites. In addition, higher power prices were achieved on some of the electricity sales in the US compared to last year.

Flexible Generation: As expected, adjusted EBITDA of the Flexible Generation segment normalised in the first three quarters of 2025, reaching €1,058 million compared to €1,447 million in the previous year. Margins on electricity forward sales were lower than in the same period of the previous year. The sale of a data centre project on the site of a former RWE coal-fired power plant in the United Kingdom to a hyperscaler had a positive impact, with a book gain of €225 million. Additional income from the short-term optimisation of power plant dispatch also had a positive effect.

Supply & Trading: At €150 million, the segment’s adjusted EBITDA was significantly lower than last year’s figure of €465 million, as expected. After a weak first half of 2025, RWE Supply & Trading recorded a strong third quarter.

Robust financial position despite high investments: As at 30 September 2025, RWE reported a net debt of €15.7 billion. This increase in debt, compared to the level at the end of 2024, is due, among other things, to the high level of investment. In the first three quarters, RWE invested €4.6 billion net in expanding its portfolio. This includes the proceeds from the sale of stakes in the Thor and Nordseecluster wind projects to Norges Bank Investment Management. RWE continues to expect to meet its self-imposed upper limit of 3.0 for the leverage factor (i.e. the ratio of net debt to adjusted EBITDA).

Outlook for 2025: RWE has confirmed its outlook for the current year, and continues to expect adjusted EBITDA of €4.55 billion to €5.15 billion and adjusted net income of €1.3 billion to €1.8 billion. This equates to €2.10 per share, based on the midpoint of the range. RWE expects to achieve adjusted net earnings per share of around €3 for 2027. For 2030, the target remains unchanged at around €4 per share. The dividend for 2025 is to be raised to €1.20 per share.

Further information on the business development in the first three quarters of 2025 and details on the outlook for the individual segments can be found in the Interim statement on the first three quarters of 2025.