RWE and Vestas agree turbine supply agreement for Vanguard West offshore wind farm

18.02.2026

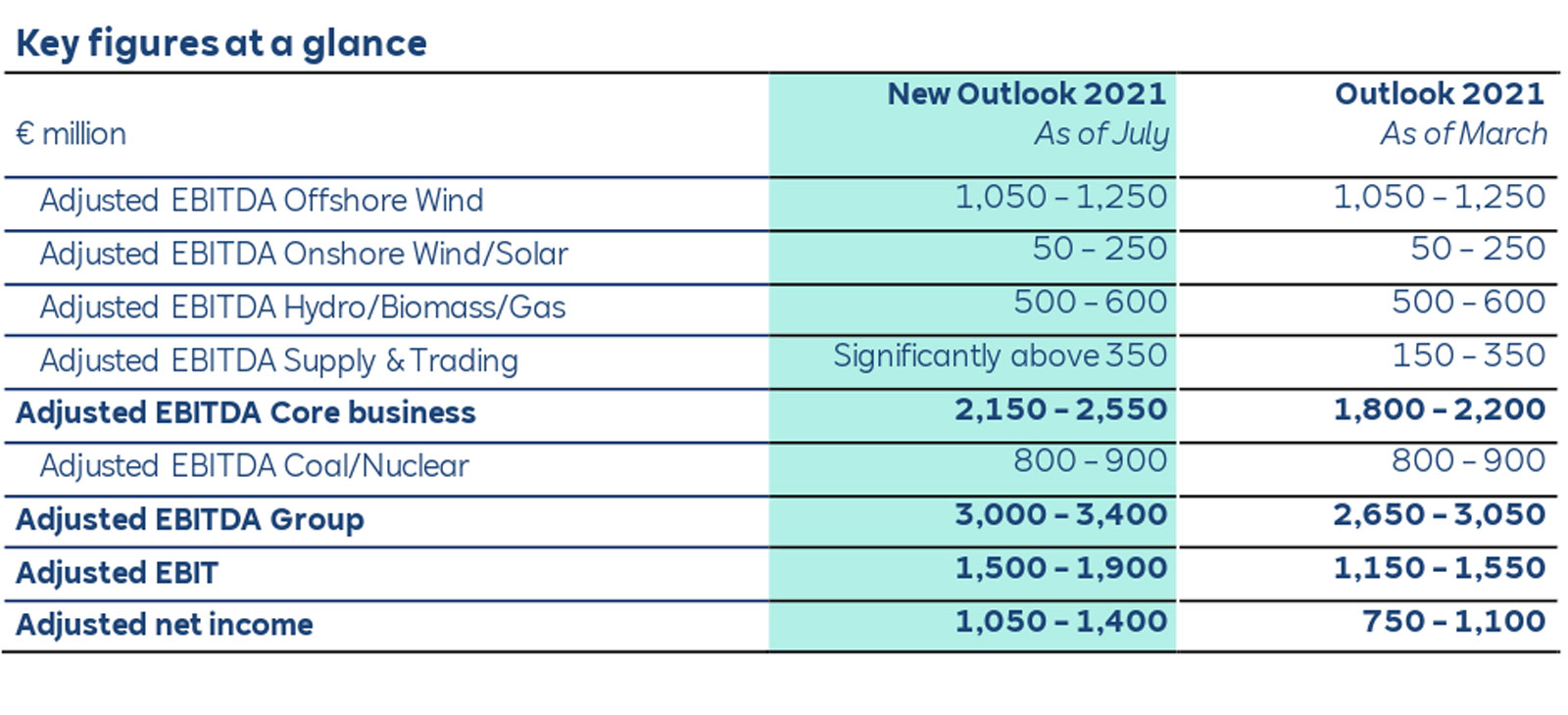

In view of the business performance in the first half of 2021, the Executive Board of RWE AG adjusted its earnings forecast for the full year 2021. It now anticipates adjusted EBITDA of

€3.0 billion to €3.4 billion (previously €2.65 billion to €3.05 billion) for RWE Group; adjusted EBITDA of the core business is assumed to range between €2.15 billion to €2.55 billion (previously €1.8 billion to €2.2 billion). The outlook for adjusted EBIT increased to €1.5 billion to €1.9 billion (previously €1.15 billion to €1.55 billion) and for adjusted net income to €1.05 billion to €1.4 billion (previously €0.75 billion to €1.10 billion). RWE sticks to its dividend target of 0.90 € per share for fiscal year 2021.

Adjusted EBITDA in the Supply & Trading division reached an exceptionally high level of €525 million in the first half year thanks to a strong trading performance. Originally RWE estimated a range of €150 million to €350 million for this segment. RWE therefore increased the outlook for Supply & Trading for FY 2021 and assumes to close the year significantly above the €350 million.

The EBITDA forecast for the other segments is unchanged.

RWE will publish its interim report for the first half of 2021 on 12 August 2021.