RWE marks the ‘Go Live’ of its first UK Solar Farm as Langford powers up

02.07.2025

RWE has invested heavily during the first nine months of fiscal 2023, including a total of €10.3 billion net in its Growing Green programme; investment in the same period last year was €3.1 billion. The acquisition of Con Edison Clean Energy Businesses in the US accounted for the largest share at €6.3 billion. The company also invested in new wind and solar power plants as well as batteries in Europe and the US, and in acquisitions in the Netherlands and the United Kingdom. As a result, the portfolio grew by 5.7 gigawatts (GW) by the end of September 2023. 100 projects with a total capacity of 7.8 GW are currently under construction in 10 countries.

Michael Müller, CFO of RWE AG: “Our strong investment activity is paying off. Our portfolio has grown by about six gigawatts since the beginning of the year. This has led to a significant increase in electricity production from renewables, which contributes to our growth in earnings. This positive trend will continue; we currently have projects representing around eight gigawatts under construction worldwide.”

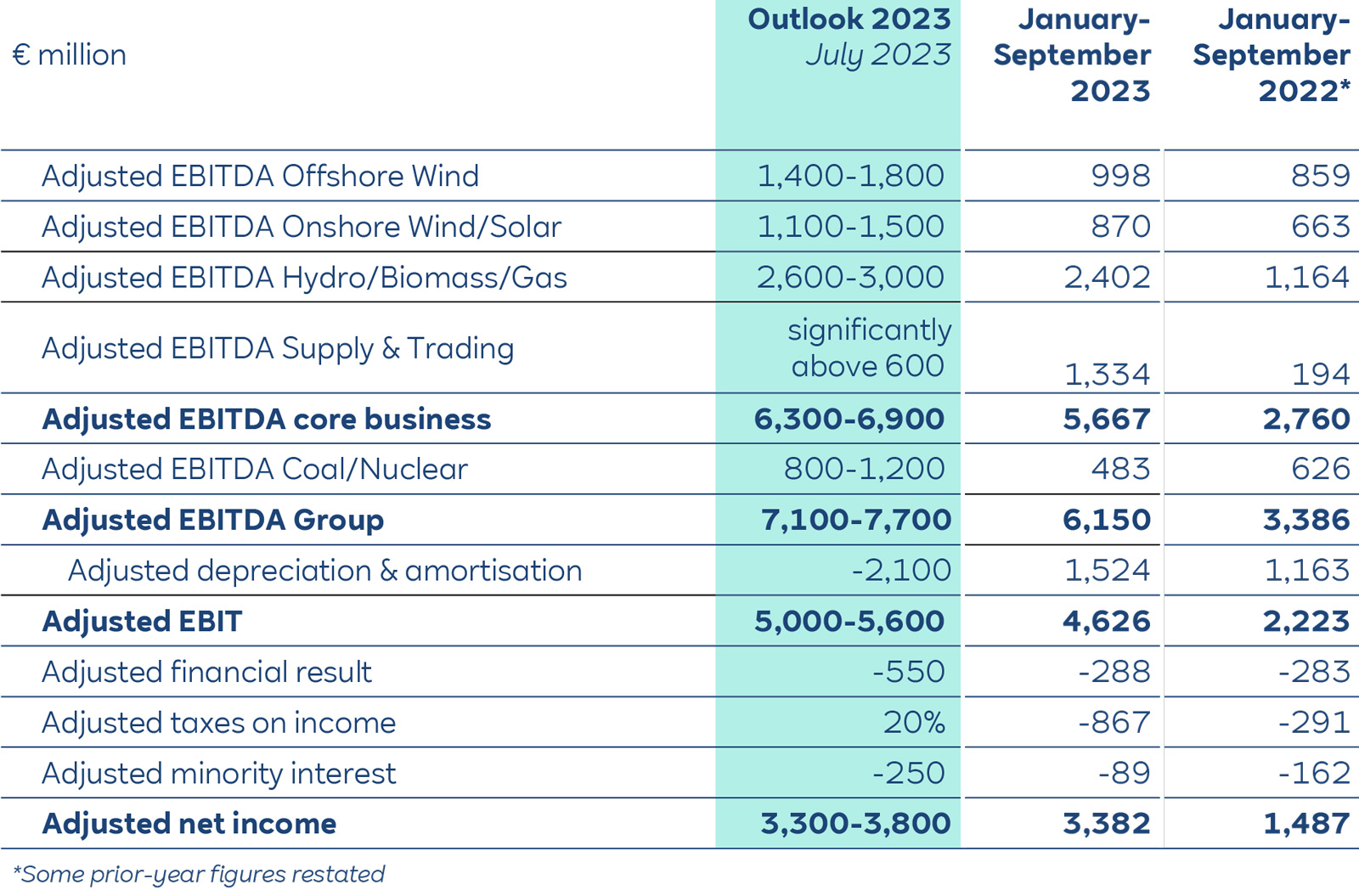

In the first nine months of 2023, RWE achieved an adjusted EBITDA at Group level of €6.2 billion and an adjusted EBITDA in the core business of €5.7 billion. Adjusted net income was at €3.4 billion. This was due to higher earnings from power generation in the Hydro/Biomass/Gas segment and a strong Supply and Trading business. The commissioning of new wind, solar and battery projects and the earnings contribution of Con Edison Clean Energy Businesses acquired on 1 March also contributed to the increase in earnings.

RWE therefore confirms its outlook for 2023 as a whole, which was raised in July. The company expects adjusted EBITDA at Group level to be between €7.1 billion and €7.7 billion; adjusted net income is expected to reach between €3.3 billion and €3.8 billion. The dividend for the current fiscal year is to be increased by €0.10 € to €1.00 per share, as already announced in March 2023.

Business performance in the first three quarters of 2023 by segment

Offshore Wind: Adjusted EBITDA in the Offshore Wind segment in the first nine months of 2023 was €998 million, compared to €859 million for the prior-year period. The increase in earnings is due to the commissioning of new capacity at Kaskasi offshore wind farm off the coast of Heligoland and Triton Knoll off the UK coast. More favourable wind conditions also had an impact, especially at the UK sites.

Onshore Wind/Solar: Adjusted EBITDA in the Onshore Wind/Solar segment reached €870 million for the reporting period, compared to €663 million in the same period last year. This was primarily due to the earnings contribution from the business activities resulting from the acquisition of Con Edison Clean Energy Businesses in the US that were fully consolidated as of 1 March 2023, as well as the commissioning of new wind and solar farms as well as batteries. Lower realised electricity prices and weaker wind conditions had a counteracting effect.

Hydro/Biomass/Gas: The Hydro/Biomass/Gas segment achieved an adjusted EBITDA of €2,402 million in the first nine months of 2023, compared to €1,164 million in the prior-year period. This was largely attributable to higher earnings from short-term power station dispatch in the international generation portfolio and higher generation margins.

Supply & Trading: Adjusted EBITDA for the first three quarters of 2023 in the Supply & Trading segment increased to €1,334 million compared to €194 million for the same period in 2022. The increase in earnings was due mainly to a one effect in the prior year: In 2022, sanctions on coal supplies from Russia led to an impairment of €748 million.

Coal/Nuclear: RWE’s German Coal and Nuclear business was the only segment to close below its prior-year level. Adjusted EBITDA declined to €483 million compared to €626 million in the previous year’s period as a result of lower margins from assets for which electricity production was not hedged. In addition, the Emsland nuclear power plant only contributed to earnings until it was shut down on 15 April 2023.

Financial situation remains solid

As at the reporting date of 30 September 2023, RWE reported net debt of €6.2 billion. The company expects the leverage factor, which shows the ratio of net debt to adjusted EBITDA for the core business, to stay well below the self-imposed upper limit of 3.0 at the end of 2023. The equity ratio rose as at the end of the third quarter of 2023 to around 33%; as at 30 September 2022 it was around 21%.

Click on the image to zoom

RWE Capital Markets Day 2023

On 28 November, RWE will present an update of its Growing Green strategy at its Capital Markets Day in London. The Capital Markets Day and the subsequent press conference will be broadcast live; all information on RWE’s Capital Markets Day 2023 can be found here.