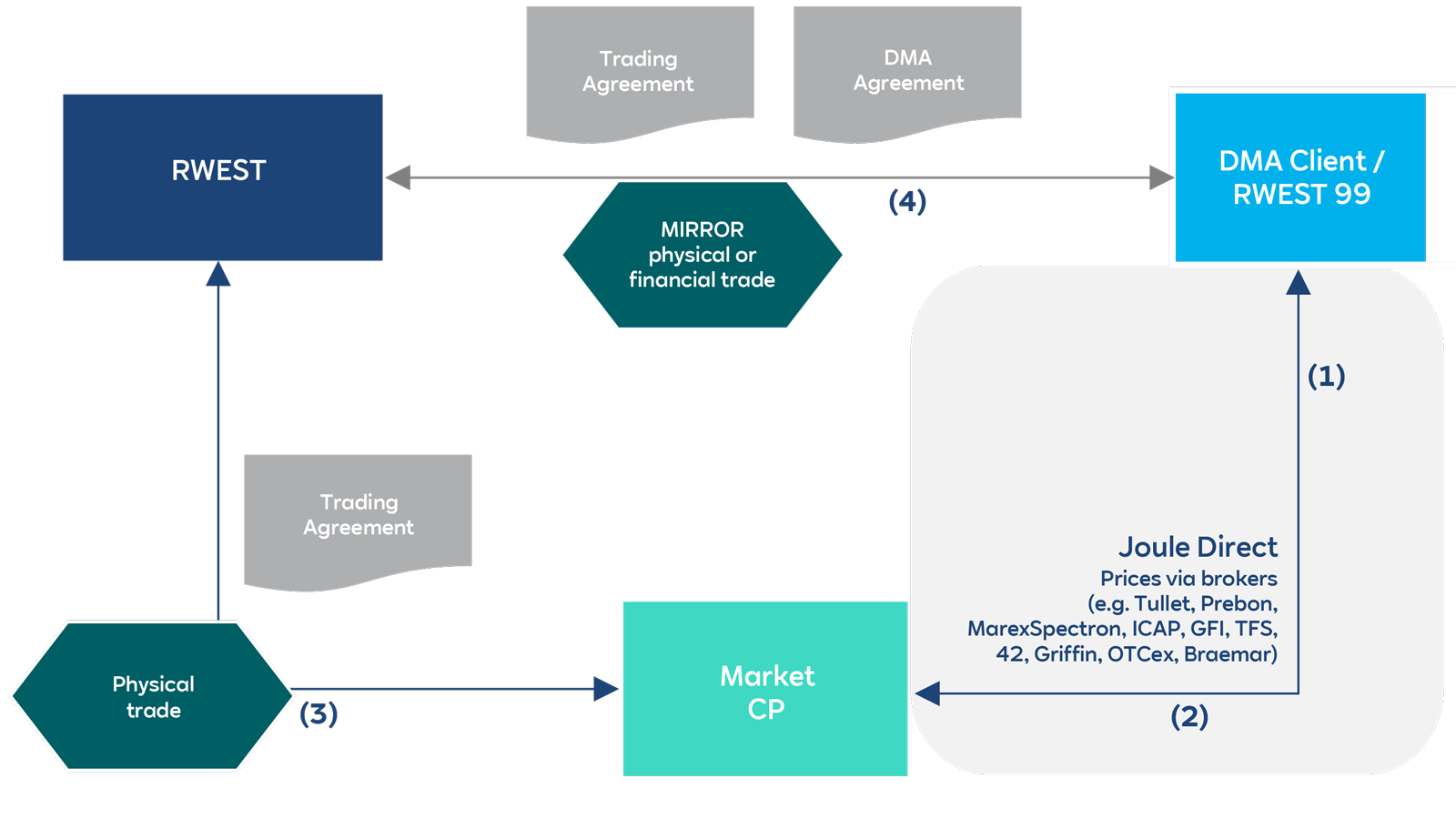

RWE Supply & Trading GmbH (RWEST) offers market participants direct access to European over-the-counter (OTC) power and gas markets through its state-of-the-art Direct Market Access (DMA) platform.

Designed for sophisticated traders, the RWEST DMA allows you to access a network of 300+ counterparties and execute trades physically or financially in the physical OTC markets.

RWEST DMA empowers third-party traders to access major power and gas hubs using the widely adopted Joule Direct trading platform, provided by Trayport Ltd. As a DMA client, you can:

- Aggress buy/sell orders of other market participants or

- Initiate your own orders for others to transact with

both via screen or via voice trading.

Trading through RWEST DMA, you operate as “RWE Supply & Trading GmbH X”, giving you the credibility and counterpart access of RWEST, but with your distinction in the market.