- RWE drives forward portfolio expansion with investments of €9 billion in first six months of 2023

- Capacity grows by 5.1 gigawatts in first half of 2023 through acquisitions and commissioning of new plants

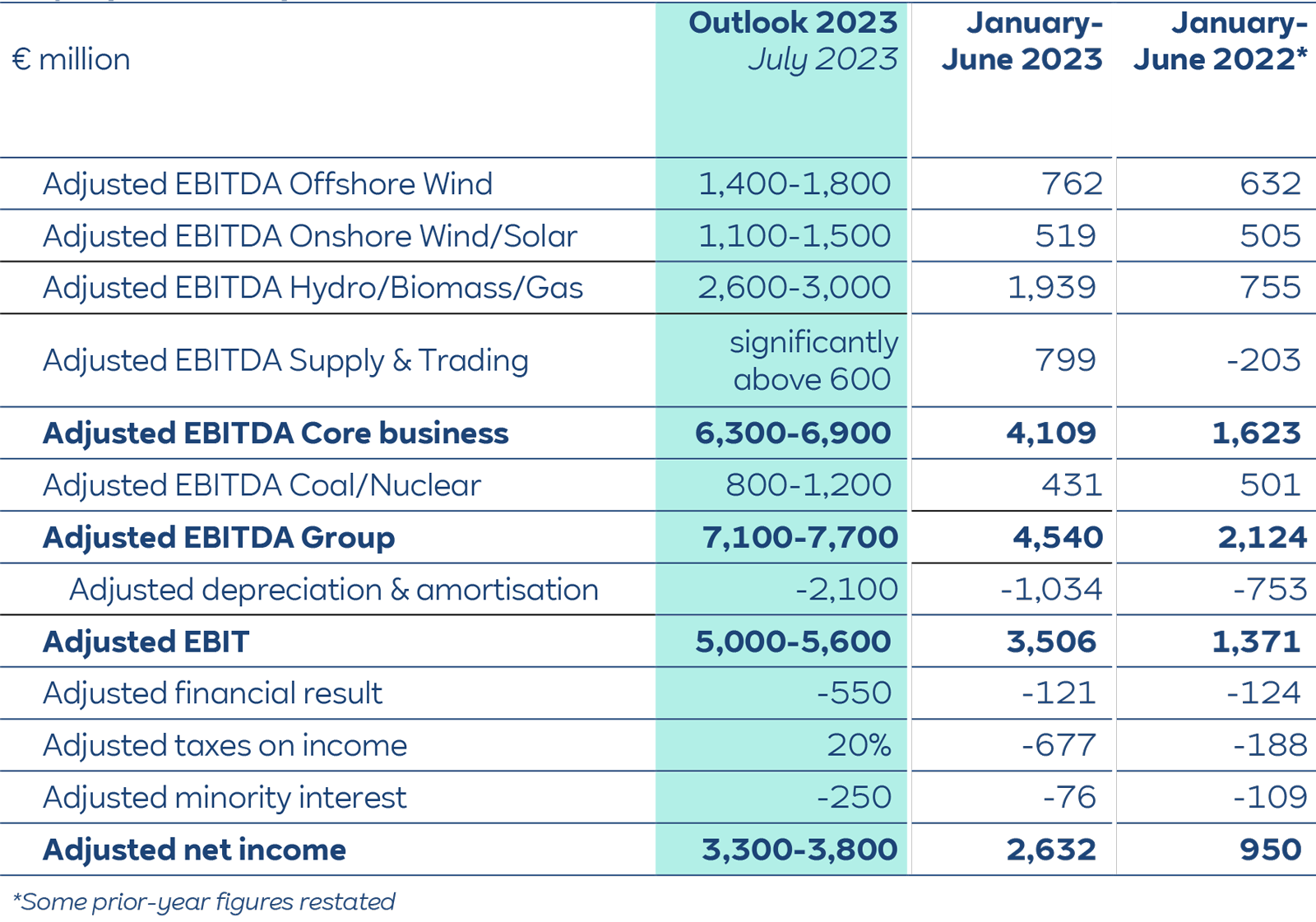

- Good operational performance in first half-year: adjusted EBITDA increases to €4.5 billion and adjusted net income to €2.6 billion thanks to higher earnings in core business

- More than 70 projects currently under construction in 12 countries, totalling 7.2 gigawatts

Building a sustainable energy system is at the core of RWE’s Growing Green strategy. In the first six months of fiscal 2023, the company once again increased its investment activity, spending €9 billion on growth compared to €2.1 billion in the same period last year. The acquisition of Con Edison Clean Energy Businesses in the US accounted for the largest share at €6.3 billion. RWE also invested in new wind and solar plants. As a result, the portfolio grew by 5.1 gigawatts (GW). Further projects with a total installed capacity of 7.2 GW are currently under construction.

The earnings for the first six months of fiscal 2023 are significantly higher than in the same period last year. Against this background, RWE had already published preliminary figures for the first half of 2023 on 25 July 2023 and raised its outlook for the fiscal year as a whole.

Markus Krebber, CEO of RWE AG: “We are investing billions of euros to drive forward the expansion of our sustainable portfolio. In the first six months of this year, we already invested €9 billion and expanded our capacity by 5.1 gigawatts through acquisitions and the commissioning of new plants. Thanks to our good results and our very solid financial position, we can keep up this fast pace: We are currently constructing more than 70 renewable energy projects in 12 countries with a total capacity of over 7 gigawatts – that’s more than ever before.”

In the first half of 2023, RWE achieved an adjusted EBITDA at Group level of €4.5 billion and an adjusted EBITDA in the core business of €4.1 billion. Adjusted net income reached €2.6 billion.This was mainly due to higher earnings from international power generation in the Hydro/Biomass/Gas Segment and a strong supply and trading business. Additional generation capacities based on renewable energies also contributed to the good result.

Business performance in first half of 2023 by segment

Offshore Wind: Adjusted EBITDA for the Offshore Wind segment amounted to €762 million in the first half of 2023, compared to €632 million in the prior-year period. The increase in earnings is due to the commissioning of new capacity, the Kaskasi offshore wind farm off the coast of Heligoland and Triton Knoll off the UK coast. This more than compensated for the overall weaker wind conditions.

Onshore Wind/Solar: The Onshore Wind/Solar segment achieved an adjusted EBITDA of €519 million in the first six months of 2023, compared to €505 million in the first half of 2022. This was primarily due to the earnings contribution from the business activities that have been fully consolidated since 1 March 2023 from the acquisition of Con Edison Clean Energy Businesses in the US as well as the commissioning of new wind and solar projects. Lower realised electricity prices and weaker wind conditions had a counteracting effect.

Hydro/Biomass/Gas: For the Hydro/Biomass/Gas Segment, RWE achieved an adjusted EBITDA of €1,939 million in the first half of 2023 compared to €755 million in the prior-year period. This was largely attributable to higher earnings from short-term power station dispatch in the international generation portfolio and higher generation margins.

Supply & Trading: Adjusted EBITDA for the first six months of 2023 in the Supply & Trading segment reached €799 million compared to -€203 million in the first half of 2022. In the same period last year, the result was negative as sanctions on coal supplies from Russia led to an impairment of €748 million.

Coal/Nuclear: The Coal/Nuclear segment achieved an adjusted EBITDA of €431 million in the first half of 2023, compared to €501 million in the previous year’s period. Earnings were lower due to a significant reduction in lignite-based electricity production compared to the previous year and lower margins from plants whose electricity production was unhedged.. Burdens also resulted from extensive maintenance of power plants. In addition, Emsland nuclear power plant only produced electricity until it was shut down on 15 April 2023.

Robust financial position

As at the reporting date of 30 June 2023, RWE reported net debt of €5.9 billion. The company expects the leverage factor, which shows the ratio of net debt to adjusted EBITDA for the core business, to stay well below the self-imposed upper limit of 3.0 at the end of 2023. The equity ratio was 30%, 9 percentage points more than at the end of last year.

The dividend for the current fiscal year is to be increased to €1.00 per share, as already announced in March 2023.